In the fast-paced world of Forex trading, success is not solely determined by technical analysis, market knowledge, or even a foolproof strategy. While these elements are critical, one of the most overlooked aspects of trading is psychology—the emotional and mental discipline required to make rational decisions in a highly volatile environment.

Emotions like fear, greed, stress, and overconfidence can cloud judgment, leading to impulsive trades that deviate from your plan. In this guide, we’ll explore how to master your mindset, control emotions, and avoid letting stress or greed dictate your trading decisions.

Why Is Trading Psychology Important?

Trading psychology refers to the mental state and emotional responses that influence your decision-making process. The Forex market operates 24/5, with rapid price movements and unpredictable fluctuations. This environment can trigger strong emotional reactions, especially when real money is on the line.

Here’s why mastering your psychology matters:

- Prevents Emotional Trading: Acting out of fear or greed often leads to poor decisions, such as chasing losses or exiting winning trades too early.

- Builds Consistency: A disciplined trader follows their plan consistently, regardless of short-term outcomes.

- Reduces Stress: Understanding how to manage emotions helps you stay calm under pressure, reducing anxiety and burnout.

- Enhances Long-Term Success: Traders who prioritize psychological resilience tend to outperform those who rely solely on luck or intuition.

Common Emotional Pitfalls in Forex Trading

Before diving into strategies for controlling emotions, it’s essential to recognize common psychological traps:

- Fear of Missing Out (FOMO):

FOMO occurs when traders enter positions impulsively because they see others profiting or anticipate big moves. This often results in buying at peaks or selling at lows, leading to losses. - Greed:

Greed drives traders to take excessive risks, hold onto losing trades hoping for a reversal, or ignore stop-loss orders. It blinds them to potential dangers in pursuit of larger profits. - Fear of Loss:

Fear causes hesitation, preventing traders from executing trades according to their strategy. Alternatively, it may lead to prematurely closing positions to avoid further losses. - Overconfidence:

After a streak of successful trades, some traders become overly confident and start taking unnecessary risks. This hubris can quickly erase gains. - Revenge Trading:

Losing streaks can spark frustration, causing traders to “chase” their losses with reckless trades instead of stepping back to reassess.

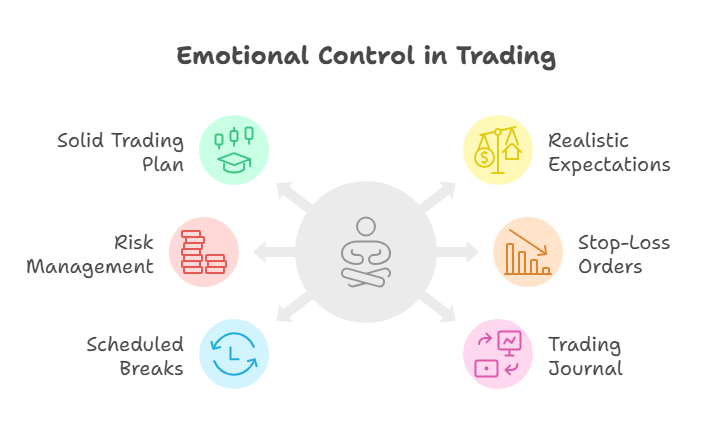

How to Control Your Emotions While Trading

Now that we’ve identified the emotional hurdles, let’s discuss actionable steps to develop a strong trading mindset:

1. Create a Solid Trading Plan

A well-thought-out trading plan acts as your roadmap, outlining entry and exit points, risk management rules, and position sizing. Stick to this plan religiously, treating it as non-negotiable. Having clear guidelines reduces the temptation to act emotionally.

2. Set Realistic Expectations

Unrealistic expectations breed disappointment and impatience. Understand that consistent profitability takes time and effort. Focus on gradual improvement rather than overnight success.

3. Practice Risk Management

Never risk more than you can afford to lose on a single trade. A general rule is to limit each trade to 1-2% of your total account balance. Proper risk management minimizes stress and prevents catastrophic losses.

Read more:

Capital Management in Forex Trading: The Key to Sustainable Success

4. Use Stop-Loss Orders

Always set stop-loss orders to protect yourself from significant losses. This removes the need for constant monitoring and eliminates the emotional burden of deciding when to exit a losing trade.

5. Take Breaks When Needed

Trading non-stop can lead to fatigue and emotional burnout. Schedule regular breaks to recharge mentally and physically. If you’re feeling overwhelmed, step away from the charts until you regain clarity.

6. Keep a Trading Journal

Document every trade, including your rationale, emotions, and outcome. Reviewing your journal regularly helps identify patterns in your behavior and highlights areas for improvement.

7. Focus on Process Over Results

Instead of obsessing over wins or losses, concentrate on following your strategy and improving your skills. Over time, good processes yield positive results.

8. Develop Mindfulness and Stress-Relief Techniques

Practices like meditation, deep breathing exercises, or yoga can help you stay centered during stressful moments. These techniques improve focus and reduce impulsivity.

9. Limit Exposure to Noise

Constant exposure to news, social media, or other traders’ opinions can amplify fear and greed. Stick to reliable sources and trust your own analysis.

10. Learn to Accept Losses

Losses are an inevitable part of trading. Instead of dwelling on them, view them as learning opportunities. Acceptance fosters resilience and keeps emotions in check.

Recognizing and Overcoming Stress and Greed

Stress and greed are two of the most destructive forces in trading. Here’s how to tackle them:

- To Combat Stress:

- Take regular breaks to decompress.

- Use visualization techniques to imagine calm scenarios.

- Trade smaller lot sizes to reduce pressure.

- To Combat Greed:

- Set profit targets and stick to them.

- Remind yourself that slow, steady growth beats risky gambles.

- Celebrate small wins to reinforce patience and discipline.

Final Thoughts

Mastering Forex trading psychology is a journey, not a destination. Even experienced traders face emotional challenges—it’s part of being human. However, by cultivating self-awareness, adhering to a structured plan, and practicing mindfulness, you can minimize the impact of emotions on your trading performance.

Remember, the goal isn’t to eliminate emotions entirely but to channel them constructively. With persistence and dedication, you’ll build the mental fortitude needed to thrive in the dynamic world of Forex trading.

Stay disciplined, stay patient, and trade smart!

What strategies do you use to manage emotions while trading? Share your thoughts below!

Comments (No)